15: Fourth Quarter 2021 Estimated Tax Payment Due: "Make a payment of your estimated tax for 2021 if you didn't pay your income tax for the year through withholding (or didn't pay in enough tax that way). 10: Employees Who Work for Tips Reporting Due Date (for December 2021): "If you received $20 or more in tips during December, report them to your employer." 7: Employment Situation Report (December). Check what will happen to the amounts you (and your employer) are allowed to contribute to employer-sponsored plans, how much you can deduct for contributions to a traditional IRA, and whether you are eligible to contribute to a Roth IRA in 2022. Changes to retirement savings rules: There are some complicated changes to the rules for contributing to various savings plans.Of note, beneficiaries with Part D or Medicare Advantage with Part D will gain access to insulin with a copay of $35 per month if enrolled in one of the plans participating in a pilot program.

How these changes will affect you will depend on your income and other factors, so check how much more (or less) you'll be paying in 2022 and take that into account for your monthly budget. For example, Part B-the plan that covers most non-hospital, medical costs-is seeing its monthly premiums rise to $170.10 in 2022 (from $148.50) and its deductible rise to $233, from $203.

BEST EXPENSE TRACKER CALENDAR SERIES

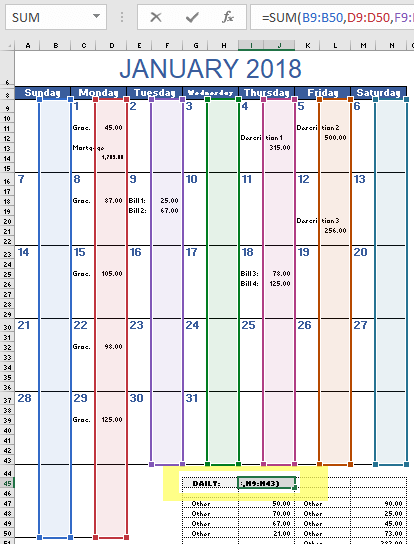

BEST EXPENSE TRACKER CALENDAR FULL

1: 2022 Social Security changes kick in: Changes include a 5.9% cost-of-living adjustment to monthly benefits, maximum taxable income increases to $147,000, the full retirement age increases by two months, the annual earnings limit for recipients increases by $600 (prior to full retirement age) or $1,440 (at full retirement age), Social Security disability benefits per month increase by $40 (non-blind) or $70 (blind).

0 kommentar(er)

0 kommentar(er)